Hydrogen has surged up the priority list of many oil and gas organizations, taking a primary position in the sector’s decarbonisation efforts, according to a new report by DNV GL.

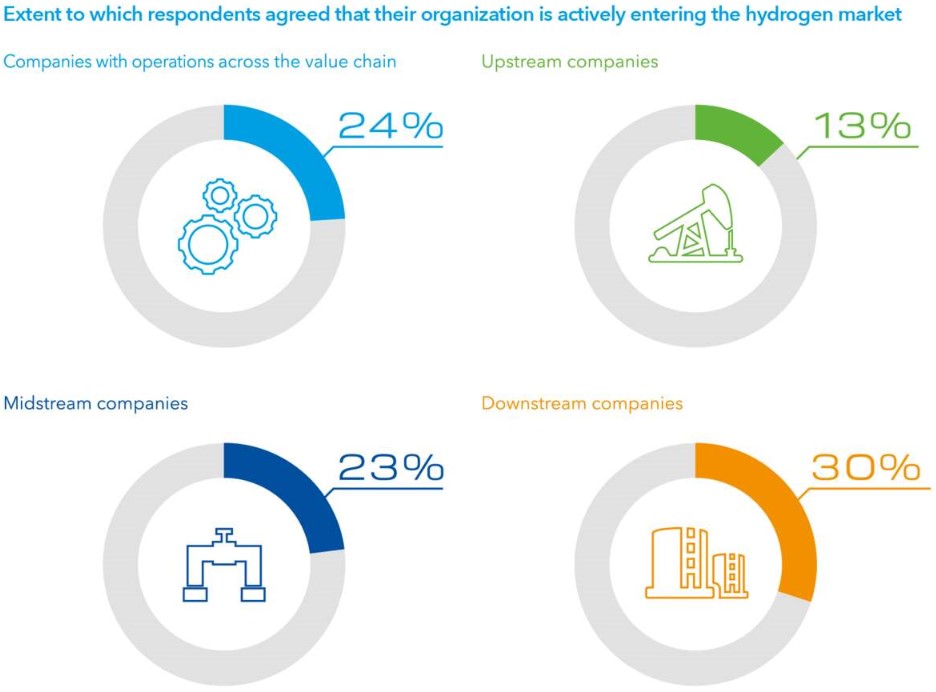

The classification society said on Thursday that a fifth of senior oil and gas industry professionals claimed their organization was already actively entering the hydrogen market.

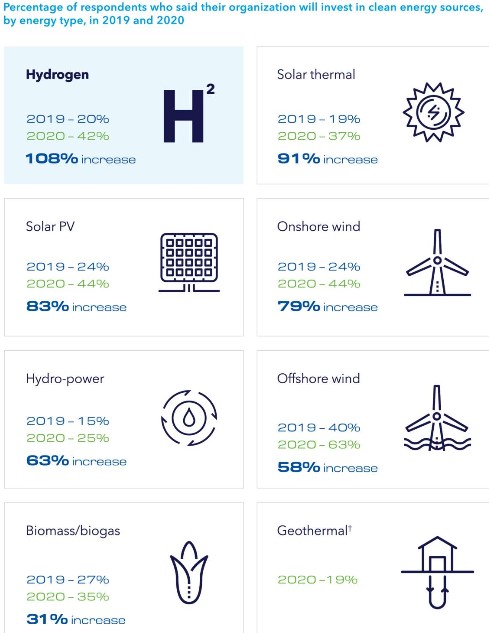

Also, the proportion intending to invest in the hydrogen economy doubled from 20 to 42 per cent in the year leading up to the coronavirus-induced oil price crash.

DNV GL’s report, aptly named “Heading for Hydrogen”, draws on a survey of more than 1,000 senior oil and gas professionals and in-depth interviews with industry executives. The report suggests that recent shifts in the industry’s investment priorities are unlikely to affect the sector’s long-term efforts to reduce carbon emissions.

The company found a significant rise in those reporting that their organization is actively adapting to a less carbon-intensive energy mix – up from 44 per cent for 2018 to 60 per cent for 2020. Carbon-free hydrogen production, transmission, and distribution are now widely recognized as central components to the oil and gas industry’s decarbonisation efforts.

Liv A. Hovem, CEO of DNV GL – Oil & Gas, said: “Hydrogen is in the spotlight as the energy transition moves at pace – and rightly so. But to realize its potential, both governments and industry will need to make bold decisions. The challenge now is not in the ambition, but in changing the timeline: from hydrogen on the horizon to hydrogen in our homes, businesses, and transport systems”.

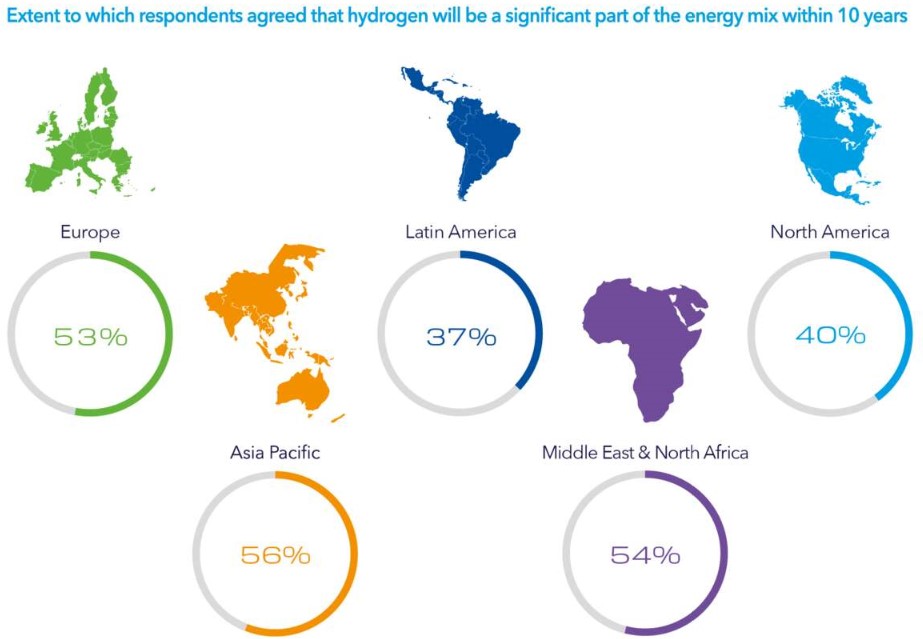

It is worth noting that more than half of respondents to DNV GL’s research in Asia-Pacific (56 per cent), the Middle East & North Africa (54 per cent) and Europe (53 per cent) agree that hydrogen will be a significant part of the energy mix within 10 years. North America and Latin America with 40 and 37 per cent, respectively, are a little behind.

Link between natural gas and hydrogen

According to Heading for Hydrogen, the success of a hydrogen energy economy is closely aligned with the future of natural gas, renewable energy, and carbon capture and storage (CCS) technology.

While hydrogen gas produced from renewable energy – so-called ‘green hydrogen’ – is the industry’s ultimate destination, analysis shows that the sector can only realistically scale up to large volumes and infrastructure with carbon-free hydrogen produced from fossil fuels combined with CCS technology, or what is known as ‘blue hydrogen’.

DNV GL’s 2019 Energy Transition Outlook, a forecast of world energy demand and supply, predicts that natural gas will become the world’s largest energy source in the mid-2020s, accounting for nearly 30 per cent of the global energy supply in 2050.

Natural gas and hydrogen can play similar roles within the global energy system, and the synergies between them – in application and infrastructure – will drive the hydrogen economy.

However, Heading for Hydrogen points to political, economic, and technical complexity in scaling the hydrogen economy.

“To progress to the stage where societies and industry can enjoy the benefits of hydrogen at scale, all stakeholders will need immediate focus on proving safety, enabling infrastructure, scaling carbon capture and storage technology, and incentivizing value chains through policy”, Hovem said.

DNV GL’s programs for hydrogen development

There are several programs DNV GL is involved in which span all four of these enabling factors. The first one is the Hy4Heat programme in the UK, which aims to establish whether it is technically possible, safe, and convenient to replace methane with hydrogen in residential and commercial areas.

Two more are the Stedin’s project attempting to demonstrating that zero-carbon hydrogen could help to decarbonize heating in a residential apartment block near Rotterdam and Gassnova’s full-scale demonstration project of carbon capture technology developed by Aker Solutions at Norcem’s cement plant in Brevik, Norway.

The final one is DNV GL’s support to governments with technical and market analysis to provide a knowledge base for decisions regarding national strategy and policy measures.